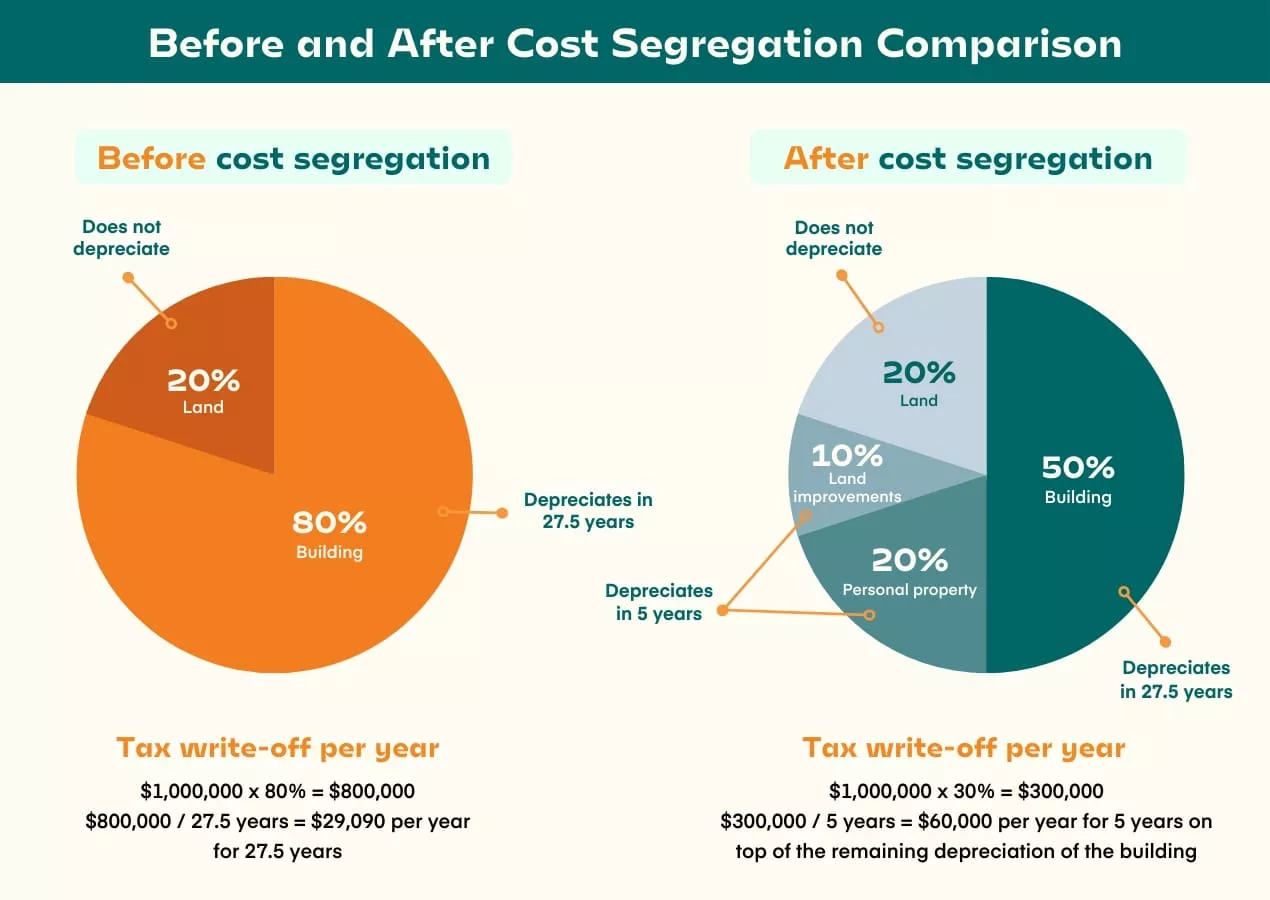

Cost Segregation is a process by which commercial property owners can accelerate depreciation and reduce the amount of taxes owed. Depreciation is a deduction that real estate investors can claim on their income taxes each year to help them recover the cost of owning, operating and maintaining that property. By using this strategy, you will reduce the amount of money you owe on your income taxes each year. This also reduces the expenses of owning investment real estate. Doing this frees up money for other investments or purchases.

You should order a Cost Segregation Study during the same year after you buy, build or remodel a property. This gives you the most tax savings when you are also spending the most dollars on your real estate. If you did not perform a Cost Segregation Study when you first built, purchased or remodeled a property, you can order a look-back study. This type of Cost Segregation Study allows you to claim a catch-up tax deduction, which you could claim in a single year. The IRS allows you to perform a look-back study on properties that you bought, built or remodeled as far back as January 1, 1987.

This IRS-sanctioned program, based on the Investment Tax Credit, could mean a savings of more than 20% on taxes for the depreciation of the non-permanent, non-structural assets of their commercial investments. Currently, the rate of depreciation for real commercial property is 39 years. The purpose of a Cost Segregation Study, then, is to separate the personal property assets from the real property assets and identify and properly classify the non-structural systems and components of a commercial property so that, under IRS guidelines, the depreciation of certain qualifying assets can be accelerated to 5, 7 or 15 years instead.

Contact us now for more detailed information on a Cost Segregation Study for your investment properties.